What does this mean?

Vietnam Mining Operation

Blackstone Minerals currently owns a 90% interest in the Ta Khoa Nickel-Cu-PGE Project which is an existing modern Nickel mine built to Australian Standards and is situated 160km west of Hanoi in the Son La Province of Vietnam. However, this mine is currently under care and maintenance. During the lapsed December quarter, Blackstone released a Scoping Study for the development and restart of its flagship Ta Khoa Project. The Scoping Study features an 8.5-year project life underpinned by the Ban Phuc DSS deposit and integrates upstream and downstream processing to produce precursor Nickel:Cobalt:Manganese (NCM) product for the Lithium-ion battery industry, vital for the production of Electric Vehicle (EV) power cells.

Blackstone’s downstream precursor NCM product significantly improves the payability of nickel, from ~70-80% to ~125-135% of London Metal Exchange (LME) metal prices and supports robust economics for the Project as highlighted in the Company’s Scoping Study, which found that the Maiden Ban Phuc DSS has an Indicated Resource of 44.3Mt @ 0.52% Ni for 229Kt. The study also highlighted an Annual production of ~12.7ktpa of Nickel over an 8.5-year project life with a Gross revenue of ~US$3.3 Billion and a Pre-tax cash flow of ~US$176mpa. The Scoping Study highlighted a pre-production capital cost of ~US$314m and a capital payback period of ~2.5 years.

The Company is now advancing the Ta Khoa Project through to a Pre-Feasibility Study, which will contemplate the option to mine higher grade MSV deposits within the Ta Khoa district.

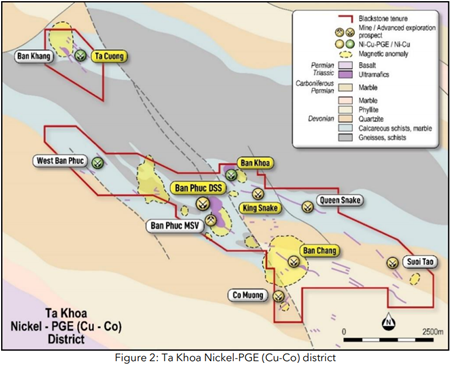

In regards to Blackstone’s geology program, the Company continued drilling with ten active drill rigs. Drilling during the quarter was primarily focussed on increasing the confidence of the Ban Phuc DSS deposit as well as targeting higher grade MSV deposits, with a view to delineate additional resources and mining inventory for ongoing studies. The areas drilled during the December 2020 quarter are shared yellow in Figure 2 below.

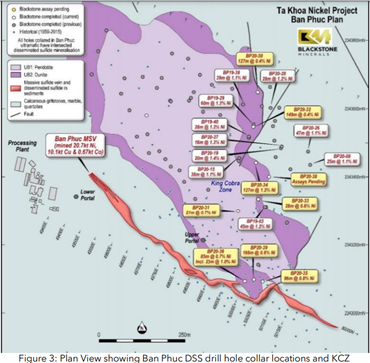

At the Ban Phuc (DSS), Blackstone has been successful in additional infill drilling at Ban Phuc and extensional drilling within the KCZ, with the results being delivered in the December 2020 quarter being some of the best intercepts to date. Some of the most significant intercepts are featured in Figure 3 below:

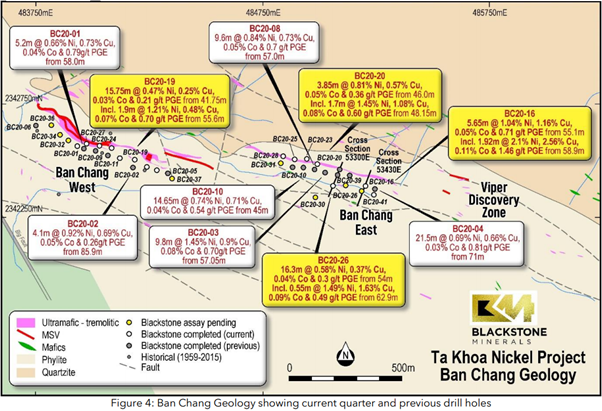

In regards to Ban Chang, Blackstone continues to target Massive Sulphite Vein (MSV) prospects analogous to the previously mined Ban Phuc MSV, where previous owners successfully mined 975kt of high-grade ore at average grades of 2.4% Ni & 1.0% Cu from an average vein width of 1.3m.

Following initial drill holes at Ban Chang which intersected high‐grade massive sulphide nickel over a 1.2km strike length, drilling success in the December 2020 quarter continued to support the Company’s strategy to delineate a Maiden Resource at Ban Chang to supplement ongoing studies. Significant intercepts for the quarter can be seen in Figure 4 below.

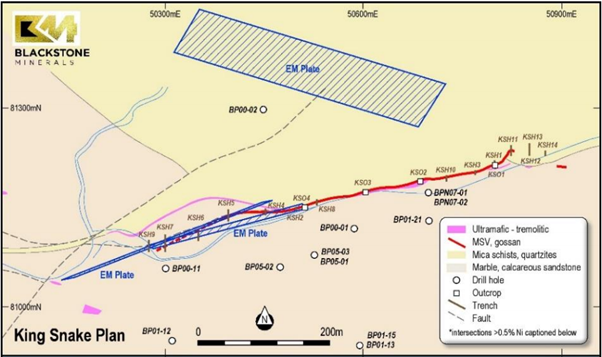

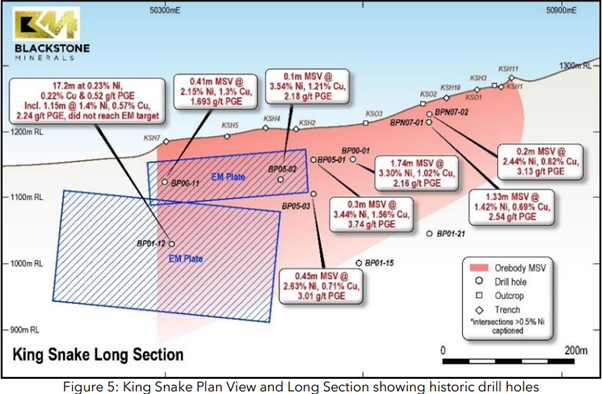

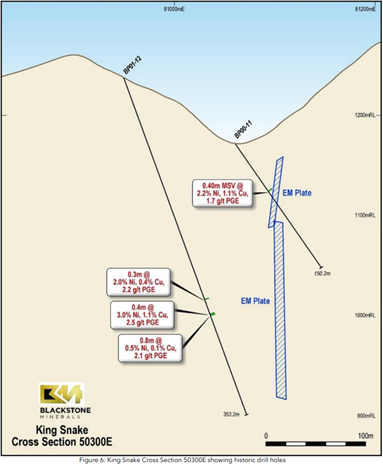

The King Snake Massive Sulphite Vein prospect was the target of a new high priority MSV generated by Blackstone’s in-house geophysics crew, situated 1.5km north-east of the processing facility. Historic drilling at King Snake by previous owners was not targeting EM plates. Refer to Figure 5 to view historic drill holes.

King Snake remains open at depth and to the west with the Company commencing an aggressive drilling program at King Snake.

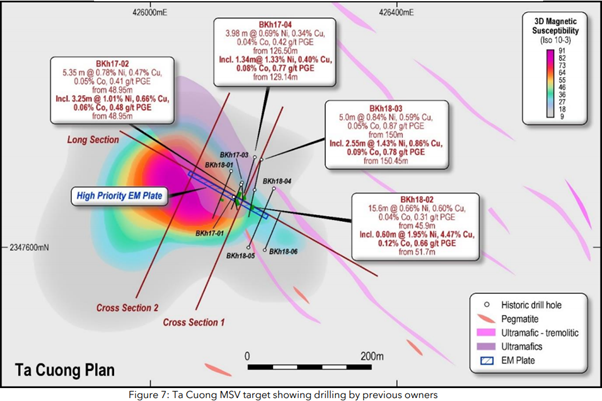

In regards to Ta Cuong (MSV), Blackstone continued to test new MSV targets identified during the December quarter. Drilling by previous owners did not target geophysical anomalies (refer to Figure 7) and assaying of historic drill holes (previously unassayed) from Ta Cuong returned the following significant results:

BKh18-02: 15.6m @ 0.66% Ni, 0.6% Cu, 0.04% Co & 0.31g/t PGE from 45.9m

Incl. 0.6m @ 1.95% Ni, 4.47% Cu, 0.12% Co & 0.66g/t PGE from 51.7m

BKh18-03: 5.0m @ 0.84% Ni, 0.59% Cu, 0.05% Co & 0.87g/t PGE from 150.0m

Incl. 2.55m @ 1.43% Ni, 0.86% Cu, 0.09% Co & 0.78g/t PGE from 150.45m

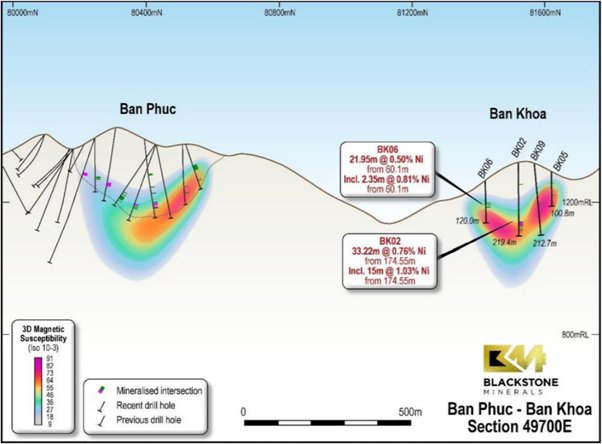

The Ban Khoa prospect is centred on an ultramafic body adjacent to the Chim Van – Co Muong Fault, approximately 1.5km north of the Ban Phuc deposit. The body is interpreted to be a 300m wide sill which has intruded into fine-grained Ban Phuc sediments. No modern drilling had been completed at Ban Khoa. Blackstone commenced drilling during the December 2020 quarter after its in-house geophysics crew generated new targets associated with the highly prospective Ban Khoa ultramafic intrusion.

The prospect is analogous to the Ban Phuc DSS orebody where the company delivered the King Cobra discovery and announced the maiden Indicated Mineral Resource of 44.3Mt @ 0.52% Ni for 229kt Ni. Ban Khoa has a combination of high priority MSV prospects within a broader DSS target associated with the Ban Khoa ultramafic intrusion.

Canadian Gold Bridge Project

The Gold Bridge Project (367 km² of tenure), formerly the Little Gem - BC Cobalt Project, is located 180 km north of Vancouver in British Columbia, Canada. Blackstone currently has a 100% interest stake in the tenement. Blackstone acquired the Gold Bridge Project in October 2017 and has since completed an extensive maiden exploration program including drilling, geochemical and geophysical surveys, with the initial results indicating potential for the project to host a world class Cobalt Belt in British Columbia.

During the 2018 field season, Blackstone identified a number of major Copper-Gold-Cobalt targets centred on the Jewel prospect, located 1.1 km north-northeast of the Little Gem prospect. Blackstone’s geological model for the Jewel prospect suggests the Copper-Gold-Cobalt prospect is well located within a similar geological setting to the underground mines of the world-class Bou-Azzer primary Cobalt district in Morocco.

Regional targets continue to be generated from the data collected through prospecting and stream sediment sampling across the entire 48 km strike of untested geology prospective for further primary Cobalt and Gold mineralisation. Blackstone is actively seeking joint venture partners for the Gold Bridge Project.

Oregon Bull Run Project

The Bull Run (Record Mine) Gold Project is located in Oregon, United States and the Company has a right to acquire a 100% interest pursuant to an Option Agreement entered into in January 2019. The option agreement allows Blackstone to explore until 31 January 2024 for an annual option fee of US$25,000 at which time Blackstone can elect to acquire the project for US$1,000,000. This project will form part of the Codrus spin-out.

Australia

Silver Swan South Project

The Silver Swan South Project comprises one granted exploration licence E27/545 and six granted prospecting licences, P27/2191 – 2196 covering an area of 38.5 km². During the quarter, Blackstone continued to work on finalising priority targets for drill testing. Black Eagle was elevated to a priority drill target following Blackstone’s second phase air-core drilling program at Silver Swan South which intersected gold mineralisation and extensive basement geochemical anomalisms that bore the following results:

10 m @ 3.2 g/t Au from 68 m within

15 m @ 2.2 g/t Au from 64 m to EOH

Red Gate Project

The Red Gate Project consists of one granted Exploration Licence E31/1096 covering an area of 145.2 km². The Project is centred 10 km north of the Porphyry Gold Mine (0.9 Moz gold endowment), 140 km northeast of Kalgoorlie. During the December quarter, Blackstone continued to work on finalising priority targets for drill testing.

Middle Creek Project

The Middle Creek Project is adjacent to Millennium Minerals Limited’s Nullagine Gold Project (where the Golden Eagle operations have produced >400 koz gold since 2012 and, as at 31st July 2018, had a 1.1Moz resource inventory), in the Pilbara region of Western Australia and consists of 21 prospecting licence applications covering 37.7 km² within the Mosquito Creek belt. During the December quarter, Blackstone continued to work on finalising priority targets for drill testing. Blackstone currently holds a 95% - 100% interest in the tenement.

Significant Events that Occurred after the December Quarter

On 15 January 2021, the Company announced the decision to spin out certain non-core gold assets into a new Initial Public Offering (“IPO”), Codrus Minerals Limited (“Codrus”). The move should hopefully see the intellectual capital from Blackstone be deployed in the management of Codrus Mineral Limited which ensures that shareholders are well poised to capitalise on their exposure to exploration upsides. We covered the announcement in an earlier article on our website.